Change of Accounting Period(AP) for Companies, Limited Liability Partnerships(LLPs), Trust Bodies & Co-operative Societies

Accounting period (AP) may also refer as financial year end (FYE). It is quite common for companies to change their AP due to the requirement of Companies Act 2016 where the holding and subsidiary companies are required to close their consolidated financial statements on the same date.

Notification of change of a AP to the Processing Department of IRBM is by submitting Form CP204B. With effect from YA 2019, companies that are changing their AP are given deadline to submit Form CP204B.

There 2 two possibilities of the change of AP, i.e. (i) the new AP is less than 12 months from the existing AP and (ii) the new AP is more than 12 months from the existing AP.

Examples

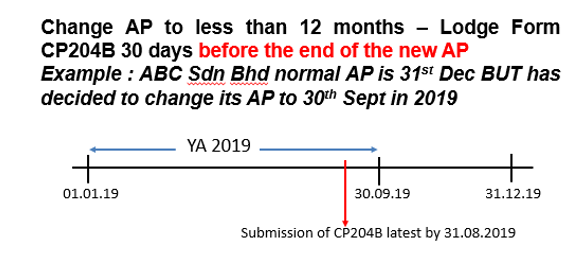

(i) the new AP is less than 12 months from the existing AP

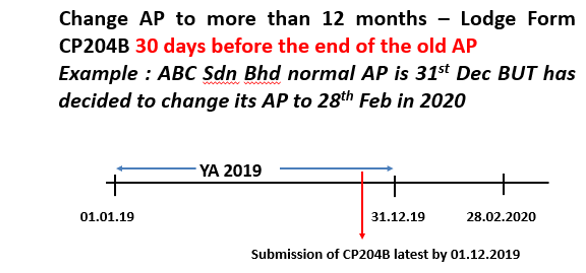

(ii) the new AP is more than 12 months from the existing AP.

Companies are required to plan properly so that they are complying with the new requirement inserted in the Income Tax 1967 effectively from YA 2019 in order to avoid penalty.

Consequences for non-compliance

Failure for companies, LLPs, trust bodies and co-operative societies to notify IRBM in relation to their change of accounting period in accordance to Sections 21A(3A) and 112(3A), will be penalised under Section 112(3), where no prosecution, a penalty of up to 3 times the amount of tax – Section 112(3).

Hence, taxpayers are advised to plan carefully for the change of accounting period in order to avoid the penalty !

Disclaimer

The contents of this article intends to share on a general understanding basis and are not intended to suit any particular individuals and/or organisation without further consulted professional advice. The writer shall not be held and accepts no liability or responsibility on whatsoever loss, damage, expense or cost to any party resulting directly and/or indirectly from the use, application and /or referral of this materials and /or contents and/or the reliance by any party, either in part or in whole.